tax abatement nyc meaning

For example if an owner has a 20-year tax abatement they. Also available is a list of all NYC Tax Incentive Programs.

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be

Homebuyers can understand the true meaning of the abatement by knowing when it will expire.

. Codes 5113 and 5118 have a 15 year term. If a co-op chooses to levy an assessment shareholders will receive both a credit and a debit on their monthly maintenance statement. A co-op tax abatement assessment is authorized by the Board of Managers also known as the co-op board.

The 2022-2023 renewal period has ended. New condominium owners must have filed a real property transfer tax RPTT. The exemption also applies to buildings that add new residential units.

Pros of 421a Tax Abatements for NYC Home Buyers. The city of Cincinnati taxes homeowners only for the pre-improvement value. Information you may find helpful in filing your.

Use CoreDatanyc to visualize properties with tax abatements. What Is The 421a Tax Abatement NYC. The debit is the amount of assessment which is based proportionally on the number of shares assigned to.

The 10-year abatement provides unit owners with a 100 abatement from property tax increases for the first two years with taxes then being increased by 20 of the current tax rate every two years for. More details can also be found in HCR Fact Sheet 41. New York NY 10038.

Homeowners can receive a 7000 exemption on their propertys assessed value for their main home if they reside in it on January 1. What Is a Tax Abatement. Tax Abatements In New York City there are tax incentive programs frequently used by owners of rent regulated buildings.

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be Homebuyers can understand the true meaning of the abatement by knowing when it will expire. Pros and Cons of 421a Tax Abatements You might think that having lower taxes is just 100 winning. A J-51 abatement is a form of tax exemption that freezes the assessed value of your structure at the level before you started construction.

Low- to middle-income residents are usually the target demographic for these programs. But there can be some drawbacks. Simply put you get a tax break for the duration of the abatement says Golkin.

At the bottom of the tax bill you will see a line for the abatement as well as its duration 25 years in this case. It also decreases your property tax on a dollar for dollar basis. Lastly Code 5114 offers a.

Like many you must have wondered what 421a tax abatement is. The J-51 tax abatement is unique for many reasons. Co-op and condo boards and managing agents must notify the Department of Finance of changes in ownership or eligibility for the Cooperative and Condominium Property Tax Abatement by February 15 or the following business day if February 15 falls on a weekend or holiday.

The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York. If you are a co-op shareholder or condo unit owner you should tell your board or managing agent if the unit is your primary residence so that you can receive the abatement. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area.

Similar to a 421a the J-51 abatement is to promote the development of multiple-dwelling affordable housing however a J-51. First of all the J-51 abatement is rare compared to the more famous 421a program. Second the J-51 program is a combination of both a tax exemption and a tax abatement.

Second the J-51 program is a combination of both a tax exemption and a tax abatement. Created by NYU Furman Center CoreData incorporates public information into an. This program provides abatements for property taxes for periods of up to 25 years.

The Idea to give tax exemption was floated in 1971 to court. Code 5116 offers a 20 year term. Abatements can last anywhere from just a few months to multiple years at a time.

The 421-a abatement was initially set to run for 10 years but can run for as long as 15-25 years in upper Manhattan and the outer NYC boroughs. To determine the beginning and end dates for tax benefits given to a building for either of these two programs visit the NYC Department of Finance J-51 Exemption and Abatement and 421-a Exemption webpages. Tax Abatement in California.

Individual unit owners cant apply for the co-op or condo abatement directly. The 421a tax abatement on a property ranges from 10 to 25 years depending on which specific code it falls under. J-51 This program administered by the NYC Department of Housing Preservation and Development HPD and the NYC Department of Finance DOF gives tax benefits to owners who rehabilitate qualifying systems in existing buildings.

New York City has several tax abatement programs in. The J-51 tax abatement is unique for many reasons. They can gain the full exemption if they file before February 15 of that year.

First of all the J-51 abatement is rare compared to the more famous 421a program. To be eligible industrial and commercial buildings must be built modernized expanded or otherwise physically improved. Here you will be able to see there is indeed a 421a tax abatement and we are in the 2018-2019 period.

Similar to a 421a the J-51 abatement is to promote the development of multiple-dwelling affordable housing however a J-51. Overall J-51 tax abatements reduce the assessed taxable value of your property while reducing the actual property tax on a dollar to dollar. Tax Abatement in Cincinnati.

Look up any address and navigate to the Portfolio Tab to look for evidence of the tax abatement under the Tax Exemptions column. Codes 5110 and 5117 offer a 10 year term. In order to see the type of 421a tax abatement you need to pull up the most recent property tax bill also on the left.

WOW now flags if a building receives J-51 and 421-a tax abatements.

How Much Is The Coop Condo Tax Abatement In Nyc

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube

What Is The 421g Tax Abatement In Nyc Hauseit

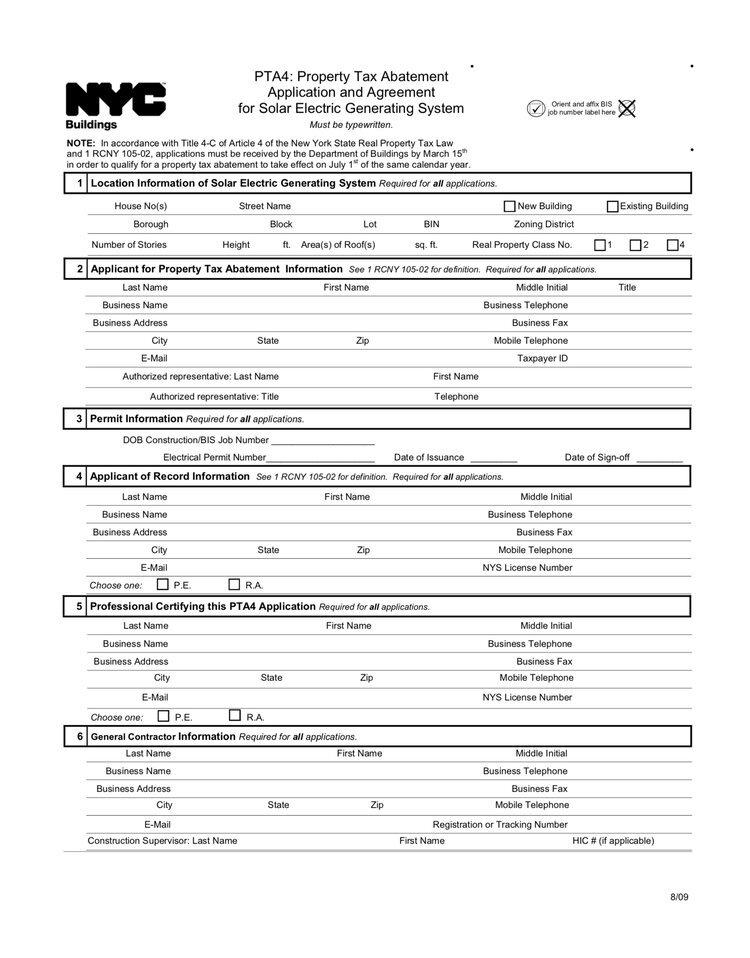

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Tax Abatement Nyc Guide 421a J 51 And More

Tax Abatement Nyc Guide 421a J 51 And More

How To Apply For The Sche Dhe Property Benefits Youtube

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be

How Much Is The Coop Condo Tax Abatement In Nyc

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Computer Rendering Of The Infinity Pool That Will Sit Atop Brooklyn Tower Pool Rooftop Pool Residential Pool

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

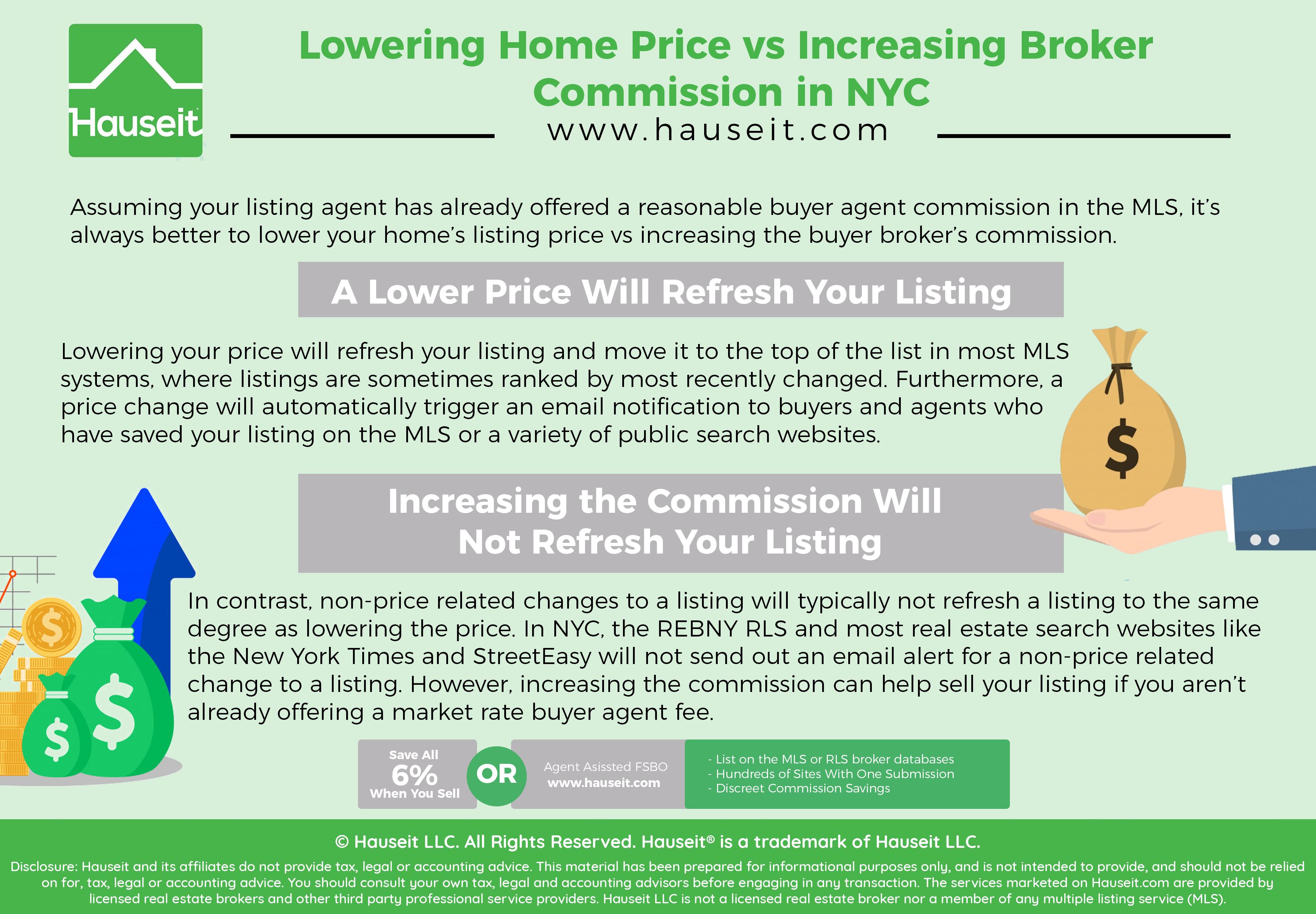

Cheapest Ways To Sell A House Hauseit Things To Sell Selling Strategies Selling House

What Is A 421a Tax Abatement In Nyc Streeteasy

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be